We’re celebrating the launch of our refreshed international data platform with a review of recent research and policy analyses which cite the UK Data Service’s international macrodata.

We’re celebrating the launch of our refreshed international data platform with a review of recent research and policy analyses which cite the UK Data Service’s international macrodata.

We offer a range of international macrodata from the World Bank, Office for Economic Cooperation and Development (OECD), International Monetary Fund (IMF), International Energy Agency (IEA) and the United Nations (UN). The data cover such wide-ranging topics as:

- Government Finance Statistics,

- International Debt Statistics,

- World Development Indicators,

- Productivity and Tax Statistics,

- Direction of Trade Statistics,

- the Human Rights Atlas

- International Energy Pricing data

(to name a few).

Tracking data usage through data citation gives an indication of the reach and significance of data in use in current debate – and of the concerns of the time. Tracking data citation reveals research reflecting the issues that affect all our lives and experiences, both close to home and internationally, covering every continent and focusing on birth, education, employment, our social interaction, our health, environment, income and attitudes, and on to old age.

Research and analysis citing international macrodata

A fair amount of the recent research and analysis citing international macrodata is focused on energy policy, finance, emissions and renewables, and in this case, using IEA data available to UK higher and further education students, teachers and researchers from the UK Data Service. Here are a few examples:

Carbon Risk and Resilience

A research paper by Siân BradleyGlada Lahn for Chatham House Royal Institute of International Affairs focuses on Carbon Risk and Resilience: How Energy Transition is Changing the Prospects for Countries with Fossil Fuels.

The paper uses the IEA Energy Balances of Non-OECD Countries: Summary Energy Balances data to understand the impact of Gross Domestic Product (GDP) growth on the energy consumption of commercial sectors. The paper explores some of the challenges that developing countries with fossil fuels face, and how their governments and development partners can respond, through the following questions:

- How might decarbonisation affect developing countries with fossil fuels and change the nature of traditional ‘resource curse’ risks, and how can scenarios help explore the impacts of this (drawing on modelled examples for Ghana and Tanzania)?

- At the country level, what policy measures and practical responses can help governments assess carbon risks and align fossil fuel sector decision-making with long-term climate and green growth goals?

- At the international level, how are Multi-lateral Development Banks (MDB) and donors responding to these trends, and where are there opportunities to improve policy coherence and coordination around carbon risks and better support transition in fossil fuel driven economies?

The paper concludes that for donors and financiers, there remains a conflict between the commitment to the ‘well below 2°C pathway’ in terms of climate change mitigation and development assistance to the fossil fuel sectors of developing countries. To deliver the long-term goal of the Paris Agreement in the least disruptive and least expensive way, fossil fuel use has to fall quickly – coal almost immediately, oil by 2030 and gas by around 2045.

Read about Steve Pye and colleague’s work on the Lancet Countdown and his Impact Case Study.

Low-carbon electricty generation

- Grantham Research Institute on Climate Change and the Environment (LSE)

- Energy Futures Lab (Imperial College London)

- Centre for Climate Change Economics and Policy (Leeds / LSE)

- Grantham Institute – Climate Change and the Environment (ICLondon)

The paper was considered as part of evidence to the UK Parliament Environmental Audit Committee on Green finance: mobilising investment in clean energy and sustainable development in May 2018 in the area of reducing risk for renewable energy investors:

“Low carbon electricity generation tends to benefit from lower operating costs, but often requires high up-front capital investments. As a result, its economics are strongly influenced by the cost of capital and the required rate of return—which is reflected in how risky an investment is considered to be. In Lord Turner’s view, the most effective way the Government could provide certainty, reduce risk and deliver investment in renewable energy was through fixed-price contracts.”

Effective carbon pricing

Rapid fuel switching from coal to natural gas through effective carbon pricing (repository copy), Grant Wilson, Department of Chemical and Biological Engineering, University of Sheffield and Iain Staffell, Centre for Environmental Policy, Imperial College London, consider how global carbon emissions from fossil fuels stand at almost 37 GtCO2/yr (carbon dioxide equivalent) and have grown by an average 23 2.4% per year so far this century.

The authors found that:

“While emissions had stabilised between 2014 and 2016 they appear to be increasing once again, intensifying the need to reduce global fossil fuel consumption. Switching away from fossil fuels is recognised as a ‘key mitigation strategy’ and ‘of crucial importance’ in the transport sector, but switching between fossil fuels in the power sector lacks such recognition as it is incompatible with longer-term deep decarbonisation.”

The authors used the CO2 Emissions from Fuel combustion data from the IEA to understand annual electricity generation from coal, gas and nuclear generation, concluding that switching between fossil fuels could provide a significant boost to global decarbonisation but that fuel switching is no silver bullet, and many barriers can explain why only a small percentage of the estimated potential has been realised thus far.

“Fuel switching can only ever be a temporary stepping stone towards a low-carbon energy system.”

Estimating a national-level energy return on investment

In Developing an Input-Output Based Method to Estimate a National-Level Energy Return on Investment (EROI), Lina I. Brand-Correa, Paul E. Brockway, Claire L. Copeland, Timothy J. Foxon, Anne Owen and Peter G. Taylor the authors note that declining energy return on energy investment (EROI) from fossil fuels and low levels of EROI for alternative energy sources could constrain the ability of national economies to continue to deliver economic growth and improvements in social wellbeing, while undertaking a low-carbon transition.

In order to test these concerns on a national scale, the authors identified a conceptual and methodological gap in relation to calculating a national-level EROI and analysing its policy implications.

They developed a novel application of an Input-Output methodology to calculate a national-level indirect energy investment – one of the components needed for calculating a national-level EROI. The authors used a mixed physical and monetary approach using Multi-Regional Input-Output data and an energy extension, describing the methodology and data requirements for the approach.

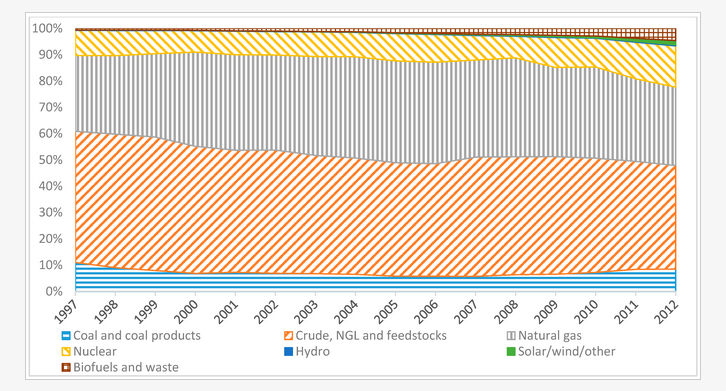

Noting that oil and gas dominate the UK’s energy production mix, the authors noted that changes in the EROI values of these particular fuels were likely to dominate the changes in the UK’s EROI. The model uses the IEA World Energy Balances: Extended Energy Balances data to identify the share of energy sources in the UK:

UK energy production: share of energy sources (1997–2012). Data taken from IEA

The approach enables quantification of EROI for national economies, particularly when calculating indirect energy inputs and represents a novel application of Multi-Regional Input-Output (MRIO) datasets – enabled by the advances in data gathering and computing power.

The authors found that the UK as a whole has had a declining EROI in the first decade of the 21st century, going from 9.6 in 2000 to 6.2 in 2012. The approach has the potential to support policies aiming to transition to a low-carbon economy.

Easy ways to #CiteTheData

We make it easy to #CiteTheData for anyone using data in their research and analysis: Search for any dataset in the data catalogue and scroll down the page. Not only is there a handy ‘Citation and copyright’ section, but there’s an easy-to-use tool to convert this citation into APA, DataCite, Harvard and Vancouver formats. For a quick overview, see our top ten tips to citing data.

We thank all the researchers who #CiteTheData.

Find international macrodata from the UK Data Service

About the author

Dr Victoria Moody is the UK Data Service Director of Impact.