Liisa-Maria Palomäki explores the paradox between higher financial satisfaction and lower income for pensioners in Europe, using data from the European Union Statistics on Income and Living Conditions (EU-SILC).

Liisa-Maria Palomäki explores the paradox between higher financial satisfaction and lower income for pensioners in Europe, using data from the European Union Statistics on Income and Living Conditions (EU-SILC).

Statistically, the financial satisfaction of European pensioners is higher, on average, than that of other population groups. This observation is contradictory since the income of pensioners is lower than that of others. This phenomenon is called the income satisfaction paradox.

In my doctoral dissertation published in June 2018, I examined whether the income satisfaction paradox could be explained by a comparison with other population groups or with the pensioners’ own pre-retirement economic status.

My research showed that both the retirement route and the economic context of the country in which a pensioner lives affects their subjective perception of their economic situation. Somewhat unexpectedly, these effects may be stronger than the actual income level. The subjective economic well-being is a complex phenomenon, in which the income is only one part of the whole.

European comparisons based on EU-SILC

Articles on the subjective economic well-being of the old age population living in different European countries were based on the European Union Statistics on Income and Living Conditions (EU-SILC) for the period 2005-2013.

The data was well suited for my research purposes as it includes individual-level cross-sectional and longitudinal components. EU-SILC also includes both objective data on income as well as subjective perceptions, that is, how people feel that they can make ends meet.

Using contextual and longitudinal analyses, I drew my conclusions regarding the significance of the comparisons based on the average income of the population groups and the individual-level labour market status.

Longitudinal analysis reveals new retirees’ subjective perception affected the most by the retirement route

Retirement is a significant phase of change in a person’s life.

It is often associated with a reduced income. One of the central focal points in the assessments of subjective well-being is a comparison to the individual’s previous economic status. Very little research exists on the impact of retirement on financial satisfaction.

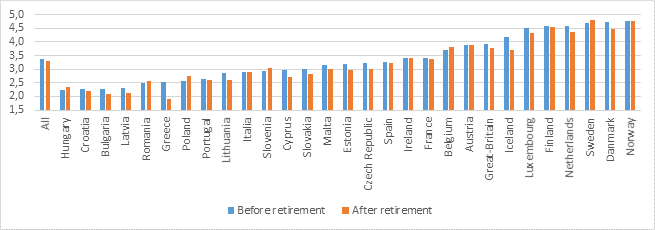

Contrary to general perceptions, the follow-up of new retirees on an old-age pension revealed that, on average, their subjective economic well-being weakened relatively little. The fluctuation is larger when comparing by country.

In the Nordic countries (with the exception of Iceland), income level is high before retirement and remains virtually unchanged after retirement. In the countries of Eastern and Southern Europe, on the other hand, pre-retirement income level tends to be lower to begin with and continues to weaken after retirement.

Figure 1. Subjective economic well-being in 29 European countries 2010-2013, mean

Scale: 1=great difficulty, 6= Very easy

Retirement is an individual process: some retire from work, some from unemployment and some from other states outside of the workforce.

The income of those who retire from employment tends to decline while it is likely to rise for those who are unemployed. For others, it varies. Taking into account change of income on a more detailed individual level did not change the fact that the financial satisfaction of those retiring from employment declined while it improved for those who retired from unemployment (in particular) but also for those who retired from other activities.

The results may indicate that the income generating from different sources, for example, from work, an unemployment allowance or a pension, come with different expectations.

Contextual analysis reveals weaker subjective perceptions in countries with a high standard of living

Subjective perception of income is partly formed through a comparison to others. In general, pensioners’ reference groups are thought to be other pensioners. There is no research on the subject, however, and no verified data on whether the reference group changes after retirement, for example, from the working age population to other pensioners.

With three possible reference groups on offer – the overall population, the working age population and pensioners – the pensioners turned out to be the reference group of both younger and older pensioners on an old-age pension. Pensioners are more likely surrounded by other pensioners, which makes it more natural for them to select pensioners as their reference group.

It was more surprising to discover that, in the European countries in which the average income of retirees was higher, pensioners perceived their own income to be more insufficient, and vice versa.

This result may speak of increased expectations regarding consumption, caused by a higher standard of living. Differences in the income distribution of the population or the pensioners was of no significance. In other words, the subjective perception of one’s own livelihood seems to be affected, in the end, by the subjective perception of the income of similar people in one’s vicinity.

Impact

Although my research did not explain the income satisfaction paradox, it revealed that the subjective economic well-being is a multidimensional phenomenon.

My research brings new perspectives to the study of income distribution and subjective wellbeing and pension policy decision making.

For example, the financial satisfaction of the elderly who are unemployed increases when they retire and get a pension. As a result, people in an unstable labour market position should be able to retire more easily than they do now. This goes against current pension policy.

European Union Statistics on Income and Living Conditions data can be accessed from the UK Data Service.

About the author

Liisa-Maria Palomäki is a researcher at the Finnish Centre for Pensions, her research focusing on pensioners’ economic well-being. She is also a PhD student at the University of Turku, Finland.